Guide to choose the best investment products according to your risk profile

The Óscar for the best film is taken by a single production every year.As wonderful that are the candidates in Liza, there can only be a winner.The same does not happen with a hypothetical Óscar to the best investment, since the variants are so many that it is almost impossible to answer the question of which is the best.

The different investor profiles, as well as the variety of products in the market with profitability and risk characteristics for almost all tastes, lead to that conclusion.However, there are a number of guidelines, approaches and information that you can and should take into account if you are going to put your money in whatever.

What is your investor profile?

Before deciding to compromise your savings, the first thing you should do is analyze yourself.Yes, forget for a moment of the product in which you think you can invest and focus on specifying your own personal goals.To do this, we recommend that you ask yourself the following questions:

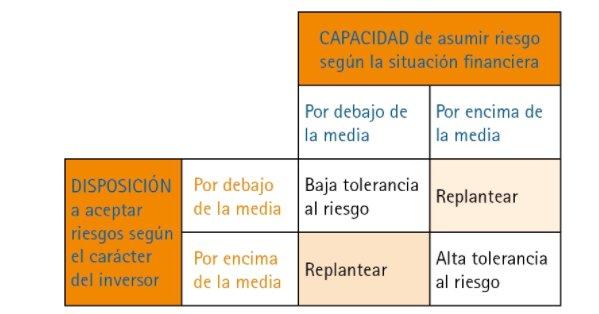

The last question will lead you to determine if you are a risky investor - control the financial world and look for high profitability despite what you can lose - conservative - your priority is to maintain the capital invested, even though you win less - or moderate, or moderate, or moderatethat is halfway between the first two.

What is the best investment?

Once you have the answers to the previous issues, it is time to think about the best products in which to invest your savings.As a general approach, yes, remember that the relationship between profitability and risk improves the higher the temporal horizon.In the same way, never forget that investment at zero risk does not exist.

Likewise, keep in mind that the decision to invest must be taken responsible, with all the necessary information and, although it seems obvious, with common sense, as advised from the National Securities Market Commission (CNMV).

To this we must add that "nobody hard to pesetas" (remembers pyramidal scams) and that, if you do not know an in -depth product it is better to accept that you do not know it and opt for another investment or look for professional advice.Thousands of investors would have preserved millions and millions of euros only having followed these simple behavior guidelines during the crisis.

What investment is it, how does it work and what do I expect from it?

After having determined your investor profile, it is time to cross your own data with which you obtain from the analysis that you must also do to the product in question.There are the key questions that I recommend, again, the CNMV:

Where to invest your savings?

In a more concrete way, here are ten more or less classic possibilities in which you can invest your savings.Again it is necessary to insist that the investment with zero risk does not exist and that the following councils are valid for the current situation.